The Harbour Club was Featured in

Dear Company Stakeholder,

Looking to acquire a competitor or a company in your supply chain?

Would you like a faster and easier way to approach these companies, structure win-win deals, and close transactions?

Jeremy Harbour, a world-renowned M&A dealmaker, will show you how to acquire a 7-figure business without using capital upfront, leverage, or lawyers.

Before we dive into the offer, here are more details about Jeremy…

One of the World’s Top M&A Experts and Dealmakers

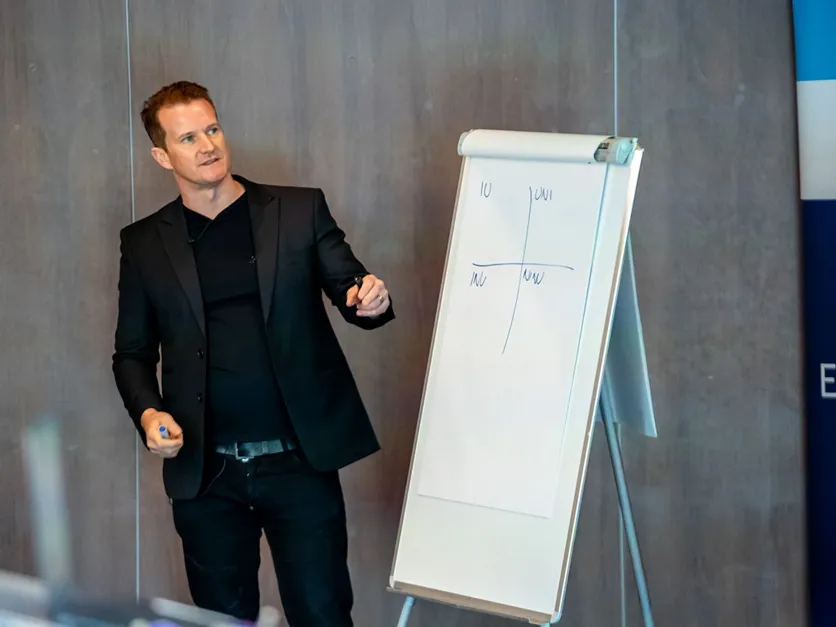

With 30+ years of M&A experience, Jeremy has bought and sold over 200 companies and advised on more than 300 deals in various industries around the globe.

Jeremy teaching M&A strategies

Listing his company on NASDAQ

Jeremy Harbour with the prince of Monaco

He has facilitated the public listing of 100 companies — including one on Nasdaq—executed reverse mergers and is an advisor to Mint Bank.

As a result of his achievements, Jeremy has appeared in Forbes, Entrepreneur, Money, Bloomberg, Sunday Times, The Financial Times, and more.

Since launching The Harbour Club in 2009–the first M&A course in the SMB/SME sector–he has built the world’s largest community of certified small business Mergers & Acquisitions professionals online with over 2,500 members.

Read Jeremy’s full bio hereJeremy’s “Deal Pie” Strategy To Structure No-Money-Down Deals

Watch this video to discover a basic no-money-down deal structure

Introducing... The Acquisition Accelerator

White-glove support to empower your own in-house deal team to acquire companies.

World-Class Training

Centi-Millionaire Advisor

One-On-One Guidance

Done-For-You M&A Leads

Networking Opportunities

Community

Support

Go Public Without Capital

Deals Closed

For You

Exclusive

Events

The World’s Leading M&A Training For

Small To Medium-Sized Business Deals

Soak up three decades of Jeremy’s M&A expertise distilled into an intense, no-fluff, three-day course called The Harbour Club.

Delivered in either an online or in-person format, you’ll discover proprietary deal structures, negotiation tactics, and techniques he’s used to buy and sell 200 companies and take over 100 companies public.

Here’s what you’ll get:

01

World-Class Training

Actionable strategies to source leads, build rapport, structure no-money-down deals, increase shareholder value fast, and exit companies.

02

Q&A Sessions and Networking

Get answers from Jeremy and network with other dealmakers to organise joint venture deals.

03

Attend Online or In-Person

Learn M&A strategies online from anywhere in the world or attend live for a more immersive experience, and meet Jeremy in person.

04

Unmatched Value

The Harbour Club usually costs $12,500. If you resat the course four times that would be $50,000 of tickets, yet it’s all included.

05

Unlimited Retakes

The 3-day course is a firehose of information. That’s why you can resit the course (either online or in person) as many times as you’d like within 12 months.

This is the ultimate and original M&A course refined over decades with nothing held back.

Get Personal M&A Advice from

Centi-Millionaire Jeremy Harbour

Imagine if you could take an investing program where Warren Buffet had weekly calls with you and even bought the stock for you.

That’s what you get here but for small to mid-sized Mergers and Acquisitions.

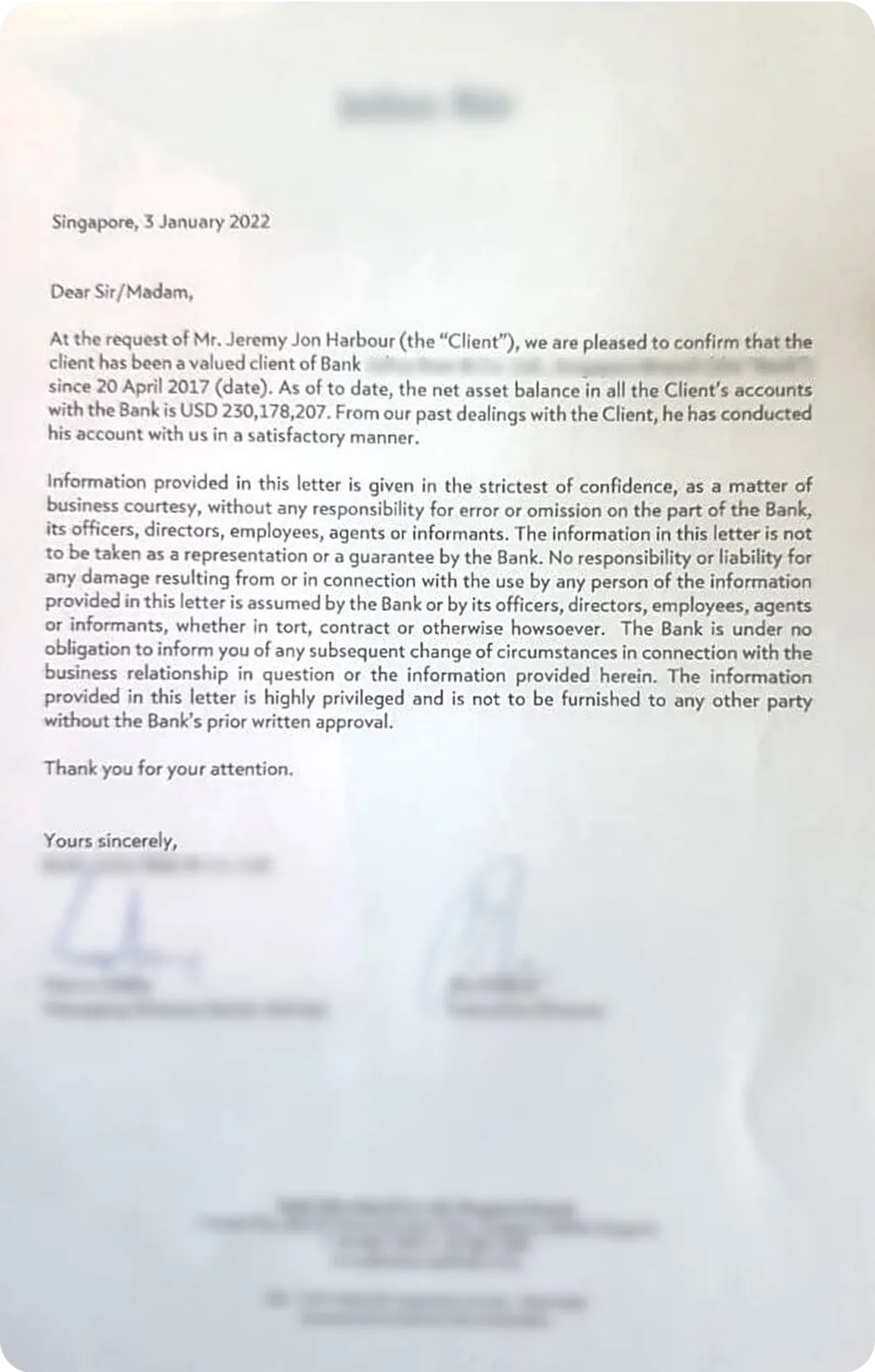

Jeremy Harbour, a dealmaker and expert who has amassed a net worth of over $230 million from M&A, can be your advisor.

This letter from his private wealth bank proves his asset holdings.

With too many so-called “gurus” running around online it’s best to show proof

Here’s what you’ll get:

One-On-One Calls with Jeremy

Quarterly private session with the most accomplished dealmaker in the industry.

Weekly AMA Sessions

Live group sessions with Jeremy every week. Ask anything about deals, strategies, or roadblocks.

30+ Years of M&A Expertise

Jeremy has completed 200+ deals, taken 100+ companies public, and advised on 300+ transactions.

Tap Into The World’s Largest

Community of M&A Professionals

With access to an international network of 2,500+ dealmakers, resources, and joint venture opportunities, you’ll have all the tools you need to close more deals faster.

Here’s what makes this community exciting:

Tap Into a Global Talent Pool

Find JV partners and collaborators. Whatever challenge you face, someone in the community has solved it.

Real-Time Support

Need advice to structure a tricky deal? Looking for recommendations? Post in the app and get insights from seasoned dealmakers.

Mastermind Networking

Connect in free mastermind groups (online and in-person) to share strategies, learn from others, and joint venture with dealmakers.

Proven Service Providers

Get a curated list of professionals (e.g. accountants, insolvency practitioners, financial advisors, etc) fluent in no-money-down deal structures, ready to work with you.

10 Years Free Community Access

This normally costs $1,800 a year. That means you get $18,000 of value at no extra cost.

Community access is only available once you complete the training component. This ensures the community is only filled with people who understand how the deals work and avoid repetitive beginner questions taught in the course.

One-on-One Guidance From a

Veteran Dealmaker Vetted by Jeremy

This is NOT a generic business coach. You’re partnered up with an expert who has closed no-money-down deals and been personally advised by Jeremy himself. Someone who’s been there, done it, and knows how to guide you.

Here’s what you get:

-

Weekly One-on-One Calls: Tailored advice to tackle every step of your deal, and stay on track.

-

Unlimited Email Support: Ask questions anytime and get clear, actionable answers, anytime.

-

Direct WhatsApp Support: Message your dealmaker for real-time guidance, whenever you need.

We’ll Find Motivated Business Sellers

and Book the Meetings for You

Spend less time hunting for deals and more time closing them. For 12 full months, our team will handle everything to connect you with qualified M&A leads.

Here’s how it works:

-

1

Targeted Research Using your LinkedIn Sales Navigator, we’ll build a custom list of targeted companies that meet your exact criteria.

-

2

Thorough Screening We’ll review profiles and websites to ensure each lead aligns perfectly with your goals.

-

3

Approval Process You approve the final list before we move forward, ensuring you speak with the best quality leads.

-

4

Outreach & Scheduling We send the messages, handle the back-and-forth, and book your meetings.

-

5

Sourcing Made Simple All you do is show up to appointments with motivated sellers, ready to negotiate and close.

This lead-generation service covers everything from A to Z. It saves you time, removes the guesswork, and keeps your pipeline full of quality leads.

Learn more about lead generationVeteran Dealmakers Who Can Close Deals For You

The goal of this program is to help you acquire a company on your own. However, if you need additional help, our seasoned experts can close them for you. These veterans have years of experience acquiring their own companies using no-money-down deal structures.

You pre-qualify the leads (i.e., take the initial calls, build rapport, determine their willingness to sell, and warm them up) and our dealmakers can handle the close. In return, they take a percentage of equity in the company you’re acquiring.

The dealmaker will…

-

Negotiate the Terms: Get the best possible deal.

-

Structure the Agreement: Handle the tricky details.

-

Finalize Everything: Ensure the deal is closed smoothly and successfully.

It’s a stress-free, time-saving way to grow by acquisition without letting anything slow you down.

Get Listed on the Stock Exchange

Without Upfront Costs

Taking a company public is complicated, expensive, and time-consuming. You’d expect to pay around $1.5 million using an investment bank and deal with endless red tape. ($3 million if you want to list on the Nasdaq!)

As part of the Acquisition Accelerator, Jeremy’s company, Unity Group, can handle the entire process and list a company for you. This could be your company or one you find.

That means…

It’s a stress-free, time-saving way to grow by acquisition without letting anything slow you down.

-

No Upfront Costs: Unity Group covers everything, including listing fees.

-

Full-Service Listing Process: They handle regulatory compliance, documentation, and every other headache.

-

Strong Pitch To Close Deals: Sell founders on having their company go public without paying cash for it–an irresistible offer to help you take a stake!

-

Higher Shareholder Value: Public companies are valued at 10-15x multiple while private ones are valued at 3-5x.

How is it even possible to get listed without cash upfront? Unity Group takes equity in the company and pays the fees. This makes it a win-win for all.

DealFest: Learn From Veteran

Dealmakers and Find JV Partners

Unlike the Harbour Club course–where Jeremy teaches his proven M&A strategies–DealFest is a 3-day, in-person event where members share their own case studies, revealing how they’ve applied those strategies to close deals.

DealFest highlights

Watch full-length segments from previous DealFests:

Delegates share case studies and tips

Q&A discussion panels with dealmakers

Here’s what makes DealFest unique:

-

Real-World Insights: Learn from delegates who completed deals as they break down how everything unfolded.

-

Collaborative Format: A mix of presentations, Q&A panels, dinners, and social events designed to deepen your knowledge and grow your network.

-

Unmatched Networking: Connect with Jeremy, Gold Inner Circle Members (who’ve closed deals), and other serious dealmakers to form partnerships and JVs.

Hang Out With Jeremy On His Superyacht

-

Join Jeremy for an evening of drinks on his 100-foot Azimut.

-

Drink, connect with delegates, and get advice from Jeremy.

-

Take in the breathtaking Dubai skyline.

Jeremy’s 100-foot Azimut superyacht

Fly High With Jeremy On His Private Jet

Bring a $10M+ EBITDA company to Unity Group (that they accept) and fly in Jeremy’s private jet to go and close the deal. It usually costs $100,000 just for the fuel!

-

Effortless Travel: Skip the queues of commercial flights and travel like the ultra-wealthy.

-

Unforgettable Flight: A once-in-a-lifetime experience you’ll talk about for years.

-

Prestige and Convenience: Impress clients, partners, or prospects with an elite travel experience.

The Million-Dollar Business Acquisition Guarantee

We guarantee you’ll acquire a 7-figure business (i.e., a company generating over $1M in revenue) using a deal structure that requires no capital upfront. If you follow the program and don’t close a deal within 12 months, we’ll partner with you until you do.

We'll roll up our sleeves and keep guiding you, generating more leads, and providing steadfast support to help you acquire a company.

With this guarantee, your success isn’t just a promise—it’s a commitment. You won’t find a safety net like this anywhere else in the world to help you acquire a business.

What’s The Investment In

The Acquisition Accelerator?

Imagine acquiring a business for no capital upfront and doubling your company’s revenue overnight.

What would that be worth to you?

$300,000?

$500,000?

How about possessing a skill that allows you to acquire businesses without capital upfront again and again?

Most business owners would agree it’s priceless.

So here’s the scoop:

If you want one-on-one advisory from Jeremy Harbour he charges $250,000.

However, because Jeremy’s direct involvement in the Acquisition Accelerator is quarterly calls–rather than weekly–you get his help for a fraction of the cost.

Here’s everything you get…

-

The world’s leading M&A training for small to medium-sized business acquisitions (unlimited resits for 12 months).

-

One-on-one calls with one of the most experienced SME Merger and Acquisition experts in the industry, Jeremy Harbour

-

Access to the largest community of certified M&A professionals to joint venture opportunities

-

We'll identify business owners and set up meetings on your behalf, ensuring your deal pipeline stays filled with leads for 12 months

-

Weekly group live AMA sessions to ask Jeremy anything and get real-time advice on your deals.

-

Get constant one-on-one guidance from an experienced dealmaker–vetted by Jeremy–via WhatsApp, email, and weekly one-on-one calls

-

Attend the in-person DealFest event where you can meet other delegates to joint venture on deals

-

Drinks with Jeremy on his superyacht. (If you were to charter the yacht for one day, you’d pay $12,000 and that’s without Jeremy on board!)

-

The option to have veteran dealmakers close the deal for you (for a slice of equity)

-

The ability to list companies publicly without upfront costs (for eligible companies)

If you’re serious about acquisitions, this program is a no-brainer.

We’ve never offered a program where we handle so much of the acquisition process for you!

And here’s the kicker: It’s not $250,000.

It’s not even $50,000.

The Acquisition Accelerator is just $36,000.

If you hired an advisor or non-exec, you’d easily pay $3,000 a month for 12 months. And yet, in that scenario, you’d miss out on our done-for-you services, networking opportunities, and ability to work with a centi-millionaire and veteran M&A dealmaker like Jeremy Harbour.

So, safe to say, this is an incredibly generous deal.

Here’s the full breakdown compared to our other offers.…

What People Are Saying About Jeremy Harbour

Case Studies of Dealmakers Acquiring Companies With No Money Down

CASE STUDY

Tom Sawyer bought a 50% stake in a flooring company for nothing upfront.

CASE STUDY

Suhail and Vic Gain Equity in a Mosaic Tile Company with $3 Million in Revenue

CASE STUDY

Leighton Herdson bought two businesses (both doing £1.2 million in turnover) without upfront capital or debt

CASE STUDY

Beverley secured a 49% stake in a company valued at 1.2 million after only few months of joining the Harbour Club

CASE STUDY

Hetas Pandya and Brian Johnson bought an $8 million electrical contractor in Australia

CASE STUDY

4 months after joining the Harbour Club Paul has closed 4 deals using the Harbour Club strategies

CASE STUDY

Sebastien Cerise bought 5 companies using Harbour Club deal structures

CASE STUDY

Daniel Priestley used the Harbour Club strategies build a group of companies

CASE STUDY

Derrick Seeto talks about several businesses he’s bought since doing the Harbour Club

CASE STUDY

Steve has used the Harbour Club strategies to find 3 deals, including one that is wort 7 figures.

CASE STUDY

Ioan Evans bought a debt-free engineering business near Cardiff (£500k net profit) with no money down.

CASE STUDY

Richard Pennack bought an engineering company in the UK for £1 upfront.

CASE STUDY

Hery Henry bought 1/3 of a company for €100 upfront.

CASE STUDY

Lana and Bart partnered up to close a deal together in the US.

CASE STUDY

Ben Stewart buys two restaurant / bars in Northern Ireland.

CASE STUDY

7 days after joining the Harbour Club Adam found 7 potential deals (he mentions how he found them in the video). His biggest deal was with a 4 million revenue company.

CASE STUDY

Chris found 4 potential deals including an 18 million a year trucking company after attending the Harbour Club.

CASE STUDY

Tony decided to use the Harbour Club strategies on his own business. He grew his business by 15% in the first 8 weeks.

CASE STUDY

Brandon bought an outdoor shelter company in New Zealand for no money down.

CASE STUDY

Susanna Hancock bought an interior fit-out business doing £1.2 million turnover for no money down.

CASE STUDY

Daniel Kepka bought an electrical contracting business for nothing upfront in Canada.

CASE STUDY

Tom Volpe bought a recruitment company a few months after attending the Harbour Club

CASE STUDY

Darren Taylor bought a franchise business for no money down.

CASE STUDY

Krystof closes his first deal in the Czech Republic.

CASE STUDY

Della K. Case Study

CASE STUDY

Simon bought a healthcare recruitment business.

CASE STUDY

Ross bought an occupational health business to bolt on to his own.

CASE STUDY

Del bought the first of his 4 businesses post-Harbour Club, which interestingly enough is the salon where he cuts his hair.

CASE STUDY

Wayne used the “Deal Pie” strategy taught in the Harbour Club to Purchase a 1.4 Million Pound Refrigerating Business after joining the Harbour Club.

CASE STUDY

Stephen bought 75% of a 2.5 Million deal. He used some interesting strategies to buy his first B2B business.

CASE STUDY

Charlene did her first no money down deal on a 900K revenue recruitment business. All within three months.

CASE STUDY

Mark bought a distressed Telecoms company for 85p within 3 months of finishing the course.

CASE STUDY

Lee closed a deal in 3 weeks by merging two IT businesses. His business is now 7 times bigger since going on the Harbour Club.

CASE STUDY

Craig, who attended the second ever Harbour Club course back in 2009, is now doing deals in the US.

CASE STUDY

Within a week of attending The Harbour Club, Richard had already closed a deal that involved buying a distressed training company for £1.

CASE STUDY

We have already seen the recent case study by Paul above, but he provided this only 10 days after finishing the course, when he had already completed two 6-figure deals

CASE STUDY

Jeanette closed 2 deals in less then 3 months of joining the Harbour Club.

CASE STUDY

Del closed a deal on his first meeting after attending the Harbour Club.

CASE STUDY

Within 4 months Lee found 4 deals, including one deal to buy a 3 million revenue company for no money upfront without borrowing or debt.

CASE STUDY

Thierry Lambert bought a healthcare business for €1 upfront.

Frequently Asked

Questions

General Questions

General Questions

Why should I choose the Acquisition Accelerator over other M&A programs?

Unlike other programs that simply teach you how to do M&A deals, the Acquisition Accelerator is the only program that guarantees you’ll acquire a 7-figure business (i.e., generating $1M or more in revenue a year) within 12 months using a no-money-down structure.

Or else, we’ll partner with you for free until you do. The program provides hands-on guidance, resources, and done-for-you lead sourcing to make the process seamless.

Who is this program for? Do I qualify?

This program is specifically for business leaders (i.e., CEOs, board members, and company shareholders) of 7- and 8-figure companies who want to grow through acquisitions (or train their in-house team to do deals) but lack the knowledge, or experience to learn everything themselves. If you meet this criteria, you’re qualified for this program.

What happens if I don’t acquire a business within 12 months?

If you don’t acquire a 7-figure business within 12 months, we’ll partner with you for free until you close your first deal. We’ll continue to source leads, provide expert one-on-one advice from a certified dealmaker, and support you in negotiations until you succeed. No extra cost.

Terms and conditions applyWhat access do I have to Jeremy Harbour?

For the Acquisition Accelerator, you’ll get direct access to Jeremy through quarterly one-on-one calls (20 minutes each) and weekly group “Ask Me Anything” sessions (up to 1 hour)

For the One-on-One Advisory with Jeremy Harbour, all your premium access as all your calls are with Jeremy himself. Weekly one-on-one calls (20 minutes), private deep-dives once every two months, quarterly accountability sessions, and unlimited WhatsApp text support from him.

Do your deal structure strategies work worldwide?

Yes. These strategies are universal because it’s more about psychological principles rather than specific jurisdictions or legal systems. That’s why delegates have used these strategies to acquire companies in countries like the UK, the US, Canada, Australia, Ireland, New Zealand, Singapore, Germany, France, Spain, Malaysia, South Africa, Barbados, Dubai, Netherlands, Czech Republic, and more.

Is this strategy too saturated?

Not at all. According to a recent Microsoft report, approximately 137,000 new companies are started every day worldwide. In the US alone, an average of 4.7 million businesses are started each year.

In fact, the first large concentration of Mergers and Acquisitions occurred between 1897 and 1904. This period, called the “Great Merger Wave” was characterized by manufacturers acquiring their competitors. Most companies from this period have disappeared but M&A has always existed. New companies always start so there are endless opportunities to do deals.

What businesses can I buy and sell using this?

You can acquire a competitor or a business in your industry, or anything else. Jeremy is sector agnostic. Over the past 30 years, he has bought all sorts of businesses (over 200 in total). Some examples are a 15,000 Sq ft health club and spa, a 33-year-old air conditioning company, a software developer company, a marketing agency, a 20-year-old PR company, and more.

What if I can’t always attend the weekly AMA calls with Jeremy?

Each call is recorded and added to The Harbour Club community app so you can watch the replays at your convenience.

I don’t have any M&A experience. Can I still buy a company?

Absolutely. This program is specifically designed for business leaders who are new to acquisitions. With step-by-step guidance, one-on-one support, and access to a community of experienced dealmakers, you’ll gain the confidence and skills needed to succeed.

What if I (or my team) are struggling to close a deal?

First, it’s a numbers game. You need to speak to many business owners to find the right fit. It could take a lot of conversations to find the right business.

Having said that, if you still want further help, our veteran dealmakers can close the deal on your behalf. (You warm up the leads and pre-qualify them, and this expert will close.) These seasoned pros have deep experience completing no-money-down deals. In return, they take an equity stake in the company you acquire.

How can I trust this program will deliver results?

Our delegates have collectively acquired hundreds of millions worth of SME/SMB companies since we launched in 2009. During a 12-month period, PKF–one of the world’s largest accounting firms–did an audit and confirmed that our delegates all together exited businesses for a total of $78,856,278. (Report available upon request.)

Furthermore, this program is the closest thing to being handed a business on a silver platter. You still need to work to make this happen. However, your pre-vetted dealmaker (i.e., someone who has actually acquired a business using no money down themselves) is there to help you every step of the way. They’ll do everything in their power to help, guide, and support you to a 7-figure acquisition within 12 months. Plus, you have our rock-solid guarantee.

What is your guarantee and how does it work?

We guarantee that you’ll acquire a 7-figure business within 12 months using a no-money-down deal structure. If you don’t, we’ll continue working with you at no additional cost until you close a deal.

Subject to our terms and conditionsWhat is DealFest?

DealFest is a 3-day event in Dubai where other delegates share real-world case studies, learn from each other, and form valuable partnerships. The event includes speaker presentations, Q&A panels, and social activities.

DealFest highlights

Watch full-length segments from previous DealFests:

Delegates share case studies and tips

Q&A discussion panels with dealmakers

Lead Generation

Lead Generation

What does the lead generation service include?

For 12 months, our team will source, screen, and organise meetings for you with business owners based on your pre-qualification criteria (i.e., approx size, industry, etc). We’ll generate marketing-qualified leads for you using your LinkedIn account. Once the appointments are booked, you meet the owners to find out if they’re a good fit and willing to do a deal.

We handle everything, from building a custom list of targeted companies to booked calls with qualified leads. You just turn up to the pre-arranged meetings and chat with business owners.

How do we find you leadsHow do you ensure the leads are high quality?

We use LinkedIn Sales Navigator, detailed research, and screening to identify businesses that meet your criteria. You approve the final list of potential sellers before outreach begins.

Will I have control over the selection process?

Yes. We handle the research and outreach, you’ll have the final say on which businesses to engage with.

Public Listing

Public Listing

What’s included in the public listing service?

Through Unity Group, Jeremy’s team can take a company public for you without upfront costs. This includes handling regulatory compliance, documentation, and the entire listing process.

How is the listing possible with no upfront costs?

Unity Group takes equity in the company being listed instead of charging upfront fees. This win-win approach allows you to access the benefits of going public without the financial burden.